Regulated information* - 10 November 2011 (07.00 a.m. CET)

Summary: Considerable progress on execution of strategic plan, 3Q results

affected by exceptional and one-off items.

KBC ended the third quarter of 2011 with an underlying net result of -248

million euros but excluding one-off items induced by the prevailing and

exceptional market circumstances, the net result would have amounted to 222

million euros. This compares with +528 million euros in 2Q2011 and +445 million

euros in 3Q2010. The underlying result for the first nine months of 2011

amounted to +937 million euros, compared to +1 542 million euros for the

corresponding period in 2010.

The IFRS-based net result reported for the quarter under review came to a net

loss of 1 579 million euros, compared with a net profit of 333 million euros in

the previous quarter and 545 million euros in the year-earlier quarter. This

means that the group has generated a total net loss of 424 million euros in the

first nine months of 2011, as opposed to a net profit of 1 136 million euros for

the corresponding period in 2010.

Jan Vanhevel, Group CEO: 'The third quarter for KBC was characterised by a

continuing good level of underlying income and considerable progress in both our

divestment and de-risking plans. We concluded the sales agreements for KBL EPB

and Fidea. We further reduced our CDO and ABS exposure and have already reached

our initial target (capital relief of 0.5 billion euros). We have also

substantially reduced our exposure to Southern European government bonds.

Unfortunately, the third quarter results were also affected significantly by

exceptional items related to the uncertain macroeconomic climate and

challenging, turbulent market conditions. We are disappointed to record a loss

in the third quarter, largely on account of these market-driven items.

However, our core strengths remain fundamentally sound and we have a very solid

customer base in our core markets of Belgium and Central Europe, where there was

further loan and deposit growth, and an excellent underlying insurance

performance. Our liquidity profile is robust and supported by a stable and

resilient customer deposit base. Moreover, our solvency position is and remains

strong and has enabled us to continue to increase lending to our customers.

I would like to add that our already comfortable capital position has been

further enhanced by the fact that the Belgian regulator has recognised the Yield

Enhanced Securities (YES) as common equity under the current CRD4 proposal. We

continue to strive to reimburse 7 billion euros to the state by the end of

2013, in line with the European plan.

KBC has expressed its intention to repay a first tranche of the YES to the

amount of 500 million euros by year end to the Federal Government under the

conversion mechanism. The Federal Government has confirmed that the 15% penalty

will be applicable. The Flemish Government has agreed to waive its "pari passu"

rights for this repayment and any further repayments effected before end of

2012.

We remain committed to executing our strategic plan with the same diligence and

determination to ensure timely repayment of the state aid and are committed to

playing an active role in the European financial sector, which will benefit our

customers, employees, shareholders and other stakeholders. The good results we

have observed during October, lead us to guide for a full year underlying net

profit of 1.2 billion to 1.4 billion euros.'

Further to a continued strong RWA management (RWA reduction of 6.7 billion euros

in the third quarter),

KBC has also acted to reduce volatility in its results.

· CDO exposure

During the third quarter, ourCDO exposure was reduced by 2.5 billion euros,

which constitutes a 12% decline in the notional amount outstanding. This was

achieved by early terminations and sales at limited cost.

· ABS exposure

During the third quarter, our ABSexposure was reduced by 0.7 billion euros,

which constitutes a 17% decline in the notional amount outstanding. This was

achieved by sales at limited cost.

· Southern European government bond exposure

In the third quarter, we substantially reduced our exposure to Southern European

government bonds. Thereduction amounted to 2.9 billion euros, or more than 30%

compared to the exposure at the end of June. We have further reduced this

exposure since the end of September by another 1.6 billion euros.

Main exceptional factors in 3Q2011 that have impacted the reported IFRS result:

· Divestments: one-off impact

Notwithstanding the particularly challenging market circumstances, the execution

of our strategic plan has gained further momentum with, for instance, sales

agreements being signed for KBL EPB and Fidea. The transactions related to the

sale of Centea and KBC Asset Management's stake in KBC Concord Asset Management

Co. Ltd. (Taiwan) have been closed, and KBC Securities completed the divestment

of its operations in Serbia and Romania. Other planned divestments are well on

track. The divestments of KBL EPB and Fidea had a combined negative impact of

0.6 billion euros on KBC's third-quarter net result, but a positive impact on

our capital.

· Impact of the credit spread on CDOs

During the third quarter, global economic uncertainty intensified, resulting in

volatile markets and significantly wider corporate and ABS credit spreads. This

resulted in a valuation markdown of some 0.6 billion euros on the CDO exposure.

30% of the unrealised losses booked in 3Q11 could already be reversed in October

2011.

Main important one-off factors in 3Q2011 that have impacted the underlying

result:

· Greece: one-off impact

As a result of the deteriorating credit position of Greece in the financial

markets, we recorded an additional impairment of 126 million euros after tax

(176 million pre-tax) on our Greek government bond portfolio in this quarter (as

a result, the impairment on Greek government bonds at 30 September 2011 was

recognised in full at 58% of the nominal amount of these bonds).

We also recorded a provision of 174 million euros after tax (263 million pre-

tax) on the contingent intention to repurchase on a voluntary basis the bonds

(KBC IFIMA 5/5/5 and KBC Group 5-5-5) sold to retail customers, conditional on

the occurrence of a credit event. These structured bonds were launched in the

spring of 2008, have a term to maturity of five years, a gross coupon of 5%

(which so far have all been paid) and are linked until their maturity to the

creditworthiness of five countries (Belgium, France, Spain, Italy and Greece).

All holders of these bonds had been informed in March 2011 of this contingent

intention. Untill the date of this press release no credit event occurred, but

since the probability of a credit event is estimated by the financial markets to

be higher than 50% on 30 September 2011, we decided to book the provision in the

third quarter results. If no credit event under ISDA definitions occurs, the

provision will be reversed.

· Hungary: one-off impact

During September, new legislation designed to help households with foreign-

currency-based mortgages was introduced in Hungary. This legislation allows

households during a limited period to pay off foreign-currency debts in one lump

sum at a fixed, discounted exchange rate. The shortfall between the fixed and

market rates is to be covered by the banks. The Hungarian Banking Association

has taken the matter to the Constitutional Court in Budapest. Nevertheless, KBC

has recorded an impairment of 74 million euros (after tax) on its FX retail

mortgage portfolio (92 million euros, pre-tax), reflecting that an estimated

20% of all debtors will pay off their foreign currency loans.

· Bulgaria: one-off impact

KBC performed an in-depth evaluation of its Bulgarian assets for which the Group

has recorded an additional impairment of 96 million euros.

Main special items in 3Q2011 that have impacted the underlying result:

· Share portfolio

Following the downturn on the stock market, an impairment of 87 million euros

(before and after tax) had to be booked on the share portfolio.

· Ireland

We indicated during the 2Q11 results presentation in August that we had seen

some deterioration in the number of payment arrears. The economic situation and

the Irish marketplace have not improved in the way we envisaged and the

austerity measures put in place by the Irish authorities have had a considerable

impact on the financial strength of households. Besides that, we have observed a

change in behaviour of some borrowers. As a consequence, a loan loss provision

of 164 million euros after tax (187 million euros, pre-tax) was recorded in

3Q2011.

These factors aside, underlying income in the third quarter was characterised by

a good level of net interest income, strict cost control, an excellent combined

ratio, good life insurance results, and robust liquidity and solvency positions.

The credit cost ratio in our core markets remains low (barring the specific

situation in Hungary and Bulgaria). Fundamentally, KBC continues to have a

strong loan-to-deposit ratio (85% at the end of September 2011) which translates

into a robust liquidity position.

With a total tier-1 ratio of 14.4% and a core tier-1 ratio of 12.6% (including

the impact of the sale of KBL EPB and Fidea), solvency remains not only firm,

but also exceeds the threshold set under the recent EBA stress test.

Under the preliminary EBA exercise based on data as at the end of June (see

press release of 27 October 2011), both KBC group and KBC Bank complied with the

9% core tier-1 threshold as determined by the EBA (capital position according to

Basel2.5, corrected with the marked-down sovereign exposures based on market

prices as at 30 September 2011). The preliminary capital buffer as identified at

the end of June is sufficient to cover 3Q11 results. An update of the outcome of

the EBA exercise based on positions and market prices as of 30 September is

expected to be published in November 2011.

Jan Vanhevel concludes: 'The operating environment has been harsh in the third

quarter and we realise that these are tough times for most economies and for

millions of people. KBC has obviously not been immune to this and our results

have been severely impacted. However, KBC continues to build on and reap the

benefits of its sound customer-driven bancassurance model, as illustrated by the

good results during October. This resulted in a strong liquidity and robust

solvency position, helping us to remain a solid European financial player

committed to actively financing our customers' projects, even in extremely

difficult conditions. The Executive Committee has decided to forego all variable

remuneration for financial year 2011, regardless of how profits develop in the

remainder of the year.'

Financial highlights 3Q2011 (underlying)

Jan Vanhevel, Group CEO, summarises the underlying business performance for

3Q2011 as follows:

Gross income benefits from stable interest income and better technical insurance

results, but is affected by lower commission income, weak trading results and

the provision set aside for the 5-5-5 products.

* Underlying net interest income stood at 1 342 million euros, at first sight

-5% year-on-year and -3% quarter-on-quarter, but this was due mainly to the

deconsolidation of Centea (excluding this factor, net interest income was

virtually flat). The net interest margin came to 1.98% for the quarter under

review, stable compared to the previous quarter and up 6 basis points on its

level of 3Q2010. In the Belgium Business Unit, both credit and deposit

volumes were up year-on-year and quarter-on-quarter (credit: +5% year-on-

year and +2% quarter-on-quarter; deposits +9% year-on-year and +3% quarter-

on-quarter). The loan book in the CEE Business Unit increased by 3% year-on-

year (thanks to the Czech Republic and Slovakia) and by 1% quarter-on-

quarter, while deposits also increased 3% year-on-year and 1% quarter-on-

quarter. In line with the strategy to run down the international loan books,

the loan portfolio in the Merchant Banking Business Unit fell 4% year-on-

year (stable in the last quarter), while the deposit base shrunk by 17%

year-on-year (8% in the last quarter), commensurate with the reduction in

the international loan book.

* A very good performance was turned in on the technical insurance front

during the quarter under review: net of technical charges and ceded

reinsurance result, technical insurance income came to 138 million euros in

3Q2011, up 52% year-on-year and 12% quarter-on-quarter. Moreover, non-life

premium income increased by 7% year-on-year on a comparable basis, and the

year-to-date combined ratio came to an excellent 90%. In life insurance, we

witnessed a significant increase in the sale of unit-linked products, both

in Belgium and in CEE, which more than offset the decrease in interest-

guaranteed products.

* The net result from financial instruments at fair value amounted to 10

million in 3Q2011, significantly below its level both in the previous

quarter and a year earlier, due to the weak performance turned in by the

dealing room in the quarter under review.

* Net fee and commission income amounted to 367 million euros, unchanged on

the year-earlier quarter, but down 7% on the previous quarter. Net fee and

commission income was hit by the relatively low level of fees generated by

the asset management business (reduced investor risk appetite).

* The other income components came to an aggregate -185 million euros. The

263-million-euro provision set aside for the contingent repayment intention

that KBC has provided its retail clients in relation to the 5-5-5 products

had a significantly adverse impact in this regard (recorded under 'Other net

income').

Operating expenses stable, significant loan loss provisions for Hungary,

Bulgaria and Ireland, and additional impairment on Greek government bonds.

* Operating expenses came to 1 172 million euros in the third quarter of

2011. This was in line (+1%) with the previous quarter and - disregarding

the booking in 3Q2010 of the Hungarian bank tax for FY2010 - also comparable

to its year-earlier level. The year-to-date cost/income ratio came to 61%

(58% excluding the impact of the 5-5-5 product), a clear indication that

costs remain under control.

* Loan loss impairment stood at 475 million euros in the third quarter, up on

the 356 million euros recorded a year ago, and up on the 164 million euros

recorded in the previous quarter, due to significant additional provisions

being set aside for Ireland, Hungary (following the new legislation on forex

loans) and Bulgaria. As a consequence, the annualised credit cost ratio

stood at 0.61% for the first nine months of 2011; this breaks down into an

excellent 0.09% for the Belgian retail book (down even further on the 0.15%

recorded for FY2010), 1.44% in Central and Eastern Europe (up from 1.16% for

FY2010) and 0.90% for Merchant Banking (down from 1.38% for FY2010).

* Other impairment charges came to 265 million in the quarter under review and

related mainly to shares in the investment portfolio (87 million euros) and

an additional impairment on Greek government bonds (176 million euros, over

and above the 139 million euros booked in the previous quarter), bringing

the fully recognised impairment to 58% of the nominal amount of these bonds.

Strong solvency capital position under Basel II.

* The group's tier-1 ratio (under Basel II) came to a strong 13.6% at 30

September 2011 (core tier-1 ratio of 11.7%). Including the effect of

divestments for which a sale agreement has been signed to date (Fidea and

KBL EPB), the pro forma tier-1 ratio even stands at approximately 14.4%

(core tier-1 ratio of 12.6%).

Highlights of underlying performance per business unit.

* The Belgium Business Unit contributed 32 million euros to profit in 3Q2011.

This was 206 million euros less than in 2Q2011. The quarter was

characterized by stable net interest income, excellent insurance results and

a very low level of loan impairments. The quarter-on-quarter decrease is

entirely related to a provision of 132 million euros (pre-tax) on the

contingent repayment intention that KBC has provided its retail clients in

relation to 5-5-5 products, and to significant impairment on shares and

Greek government bonds in the investment portfolio.

* The CEE Business Unit (Czech Republic, Slovakia, Hungary and Bulgaria)

posted a loss of 40 million euros in 3Q2011, as opposed to a profit of 146

million euros in the previous quarter. Good life insurance sales, a

favourable combined ratio and a stable net interest income defined this

quarter. The decrease was almost entirely due to the impairment taken on the

loan portfolios of Hungary (forex mortgages) and Bulgaria, and on Greek

government bonds.

* The Merchant Banking Business Unit posted a loss of 196 million euros in

3Q2011, as opposed to 63 million euros in profit recorded in 2Q2011. The

decrease is due mainly to the provision of 132 million euros (pre-tax) on

the contingent repayment intention the KBC has provided its retail clients

in relation to the 5-5-5 products, to higher impairment charges on loans and

receivables in Ireland and a weak dealing room result.

* It should be noted that all planned divestments in the KBC group (including

those that originated from the change to the strategic plan in mid-2011,

i.e. Kredyt Bank and Warta in Poland) are not included in the respective

business units, but have been grouped together in the Group Centre in order

to clearly indicate the financial performance of the long-term activities

and the planned divestments separately. In 3Q2011, the Group Centre's net

result came to -44 million euros, compared to 81 million euros in the

previous quarter. The result was impacted by the -43-million-euro (pre-tax)

impairment on Greek bonds (over and above the -36 million euros recorded in

the previous quarter) and the divestment of Centea, among other factors.

Substantial negative value adjustments dominate exceptional items.

* The quarter was also characterised by a number of exceptional items that

were not part of the normal course of business and were therefore excluded

from the underlying results. Their combined impact in 3Q2011 amounted to a

negative 1.3 billion euros. Apart from some smaller items, the main non-

operating items in 3Q2011 were:

* a valuation markdown of 0.6 billion euros on the CDO exposure (resulting

mainly from a widening of corporate and ABS credit spreads).

* a negative 0.2 billion euros marked-to-market change in the value of the

position in trading derivatives used for hedging purposes, primarily

because of a further widening of government spreads.

* a positive 0.2 billion euros marked-to-market change regarding KBC's own

credit risk.

* a negative 0.1 billion euros impairment on goodwill for CIBank in

Bulgaria.

* a negative 0.6 billion euros as a result of the sales agreements signed

for KBC EPB and Fidea.

First nine months of 2011: results per heading (IFRS)

Explanations per heading of the IFRS income statement for the first nine months

of 2011 (see summary table on the next page):

* The IFRS net result for the first nine months of 2011 (further referred to

as 9M2011) amounted to -424 million euros, as opposed to +1 136 million

euros recorded in the same period of 2010.

* Net interest income amounted to 4 142 million euros in 9M2011. On an

underlying basis and excluding companies that have since been sold, net

interest income was up 1% year-on-year. On a comparable basis, the loan book

increased by 1% year-on-year. In line with our intention to scale down our

international loan book outside our home markets, the loan portfolio

contracted by 4% year-on-year in Merchant Banking and by 2% in the Group

Centre. On the other hand, the loan books in our core markets of Belgium and

CEE, grew by 5% and 3% year-on-year, respectively. Mortgage loans

contributed significantly to this growth, with a year-on-year increase of as

much as 8% for Belgium and 4% for CEE. Customer deposits rose by 9% in

Belgium, by 3% in CEE and fell significantly in Merchant Banking and the

Group Centre. The net interest margin remained more or less the same, both

in Belgium and in CEE.

* Net of technical charges and the ceded reinsurance result, technical

insurance income came to 379 million euros, up a good 57% on the year-

earlier figure. The first nine months of 2011 were characterised by a

relatively low level of claims. The combined ratio for the group's non-life

insurance companies came to an excellent 90% for 9M2011 (85% in Belgium,

93% in CEE), a significant improvement on the 100% for FY2010.

* Net fee and commission income amounted to 877 million euros in 9M2011, down

4% on its 9M2010 level. In the period under review, sales of commission-

based products remained subdued, and assets under management fell 9% year-

on-year to 193 billion euros at the end of September 2011(150 billion euros

when excluding KBL EPB), both on account of the negative investment

performance and net entry effect.

* The net result from financial instruments at fair value (trading and fair

value income) came to -613 million euros in 9M2011, compared to -506 million

euros in 9M2010. On an underlying basis (i.e. excluding exceptional items

such as value adjustments to structured credit, results related to the

activities of KBC Financial Products that are being wound down, and after

shifting all trading-related income items to this income statement line),

trading and fair value income amounted to 371 million euros in 9M2011, down

49% on its year-earlier figure.

* The remaining income components were as follows: dividend income from equity

investments amounted to 70 million euros, the net realised result from

available-for-sale assets (bonds and shares) stood at 86 million euros and

other net income totalled 53 million euros. This last item has been impacted

by a provision of 263 million euros recorded in 3Q2011 for the contingent

repayment intention that KBC has provided its retail clients in relation to

the 5-5-5 products.

* Operating expenses amounted to 3 301 million euros in 9M2011, 2% higher than

in 9M2010, with such factors as inflation, wage increases and the higher

banking tax offsetting the effect of deconsolidated entities. The

underlying cost/income ratio for banking - a measure of cost efficiency -

stood at 61% in 9M2011, up on the 56% recorded for FY2010 (increase also

clearly attributable to the lower level of total income, cf. provisioning

for the 5-5-5 product).

* Total impairment stood at 1 377 million euros in 9M2011. Impairment on loans

and receivables amounted to 733 million euros, down on the 990 million euros

recorded in 9M2010, notwithstanding the high level recorded in 3Q2011 for

Ireland, Hungary and Bulgaria. As a result, the annualised credit cost ratio

for 9M2011 came to 0.61%, an improvement on the figure of 0.91% for FY2010.

Other impairment charges totalled 644 million euros in 9M2011 (versus 111

million euros in 9M2010) and relate mainly to the impairment recorded on

Greek government bonds in the second and third quarters (315 million euros,

pre-tax), on shares in the investment portfolio (106 million euros) and on

goodwill (79 million euros, related to CIBank in Bulgaria, among other

things).

* Income tax amounted to 245 million euros for 9M2011.

* At the end of September 2011, total equity came to 17.4 billion euros, a

1.3-billion-euro decrease compared to the start of the year, due mainly to

the inclusion of the negative result (-0.4 billion euros) for 9M2011 and the

dividend and state coupon paid (-0.9 billion euros, combined). The group's

tier-1 capital ratio - a measure of financial strength - stood at a sound

13.6% at end-September 2011.

Other information

Strategy highlights and main events

* KBC's core strategy remains centred around bancassurance in Belgium and a

selection of countries in CEE (Czech Republic, Slovakia, Hungary and

Bulgaria). In line with its strategic plan, which was amended in July 2011

(the intended IPO of a minority share in CSOB was replaced by the divestment

of Kredyt Bank and Warta in Poland, among other things), the group is

continuing with the sale or run-down of a number of (non-core) activities

(see further).

* In 3Q2011, we continued to implement our strategic refocusing plan:

* On 1 July 2011, the sale of Centea to Crédit Agricole (Belgium) was

closed. This deal freed up around 0.4 billion euros of capital for KBC,

primarily by reducing risk-weighted assets by 4.2 billion euros, which

boosted KBC's tier-1 ratio by around 0.4%. The gain on the deal is

limited.

* On 3 August 2011, it was announced that KBC Securities had divested its

operations in Serbia and Romania, after reaching an agreement on

management buy-outs with local management (very limited impact on the

earnings and capital of the group).

* On 10 August 2011, the sale of KBC Asset Management's 55.46% stake in

KBC Concord Asset Management Co. Ltd. to Value Partners Ltd. was closed

(very limited impact on the earnings and capital of the group).

* On 10 October 2011, KBC reached an agreement with Precision Capital for

the sale of its private banking subsidiary KBL European Private Bankers

('KBL EPB') for a total consideration of 1 050 million euros (50 million

of which depends on the results of KBL EPB ('conditional earn out')).

The transaction will release a total of approximately 0.7 billion euros

in capital for KBC, resulting in a 0.6 % increase in KBC's tier-1 ratio.

In addition, over the last 18 months, some 115 million euros in capital

has already been released as a result of a reduction in risk-weighted

assets. The transaction impacted the 3Q2011 results to the tune of

approximately -0.4 billion euros. Closure of the transaction is subject

to the customary regulatory approval.

* On 17 October 2011, KBC reached an agreement with J.C. Flowers & Co. for

the sale of its subsidiary Fidea for a total consideration of 243.6

million euros, including a 22.6 million euros pre-completion dividend

and subject to pricing adjustments on closing accounts. In total, this

deal will free up around 0.1 billion euros in capital for KBC, primarily

by reducing risk-weighted assets by 1.8 billion euros. The overall

positive impact on KBC's tier-1 ratio is around 0.1%. The transaction

impacted the results to the tune of roughly -0.1 billion euros. Closure

of the transaction is subject to the customary regulatory approval.

* A number of companies are still scheduled for divestment. The sales

processes for Kredyt Bank, Warta and KBC Bank Deutschland have started,

and the files for the sales process for Antwerp Diamond Bank are being

prepared.

* KBC's main objective in this respect is and remains to implement the

plan within the agreed timeframe and to repay the Belgian authorities in

a timely manner. KBC also intends to maintain a regulatory tier-1

capital ratio of 11%, according to Basel II banking capital adequacy

rules.

* Other main events in 3Q2011:

* The deteriorating credit position of Greece in the financial markets led

to an impairment of an additional 126 million euros (after tax) being

recorded on our Greek government bond portfolio (fully recognised at

58% of the nominal amount), while a provision of 174 million euros

(after tax) was set aside for the contingent repayment intention that

KBC has provided its retail clients in relation to the 5-5-5 products.

* During September, the bill on FX debt rescheduling became law in

Hungary. Although the matter has been taken to the Constitutional Court

in Budapest, KBC has recorded an impairment of 74 million euros (after

tax) on this portfolio, reflecting an anticipated 20% participation rate

in the scheme.

* In Bulgaria, a thorough evaluation of the underlying asset values has

led to an impairment of 96 million euros being recorded. An impairment

of 53 million euros has also been recorded on the goodwill for CIBank.

* Following the stock market downturn, impairment of 87 million euros

(before and after tax) had to be recorded on the share portfolio.

* Given that the economy and Irish marketplace have not improved in the

way we envisaged and that the austerity measures have had a considerable

impact on households, a loan loss provision of 164 million euros (after

tax) was recorded for the Irish loan book.

* The substantial widening of corporate ABS credit spreads between end-

June and end-September resulted in a valuation markdown of 0.6 billion

euros (after tax) on the CDO exposure.

* The considerable widening of government spreads between end-June and

end-September resulted in a negative 0.2 billion euros (after tax)

marked-to-market change in the value of the position in trading

derivatives used for hedging purposes.

* The widening of KBC's credit spread between end-June and end-September

resulted in a positive 0.2 billion euros (after tax) marked-to-market

change regarding KBC's own credit risk.

* Under the preliminary EBA exercise based on data as at the end of June

(see press release of 27 October 2011), both KBC group and KBC Bank

complied with the 9% core tier-1 threshold as determined by the EBA

(capital position according to B2.5, corrected with the marked-down

sovereign exposures based on market prices as at 30 September 2011). The

preliminary capital buffer as identified at the end of June is

sufficient to cover 3Q11 results. An update of the outcome of the EBA

exercise based on positions and market prices as of 30 September is

expected to be published in November 2011.

* We have also acted to reduce volatility in our results. During the third

quarter, our CDO exposure was reduced by 2.5 billion euros, which

constitutes a 12% decline in the notional amount outstanding. This was

achieved by early terminations and sales at limited cost. During the

third quarter, our ABS exposure was reduced by 0.7 billion euros, which

constitutes a 17% decline in the notional amount outstanding. This was

achieved by sales at limited cost.

* KBC responded to the market developments of recent months by further

reducing in an efficient manner its government bond exposure to PIIGS

countries, cutting it from 9.6 billion euros at 30 June 2011 to 6.7

billion euros at 30 September 2011. Moreover, KBC has since further

reduced its exposure by a nominal amount of 1.6 billion euros (by the

end of October).

* The Belgian regulator has confirmed to us that the YES (Yield Enhanced

Securities) will be fully grandfathered as common equity under the

current CRD4 proposal.

* This news item contains information that is subject to the transparency

regulations for listed companies.

Quarterly report 3Q2011:

http://hugin.info/133947/R/1561833/484176.pdf

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: KBC Groep via Thomson Reuters ONE

[HUG#1561833]

Top-News

Earnings Statement KBC Group, 3Q 2011

Donnerstag, 10.11.2011 07:05 von Hugin - Aufrufe: 188

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

-1

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.

Andere Nutzer interessierten sich auch für folgende News

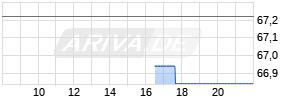

Kurse

|

Werbung

Weiter abwärts?

| Kurzfristig positionieren in KBC Groep | ||

|

UL49J1

| Ask: 1,02 | Hebel: 4,56 |

| mit moderatem Hebel |

Zum Produkt

| |

UBS

Den Basisprospekt sowie die Endgültigen Bedingungen und die Basisinformationsblätter erhalten Sie hier: UL49J1,. Beachten Sie auch die weiteren Hinweise zu dieser Werbung. Der Emittent ist berechtigt, Wertpapiere mit open end-Laufzeit zu kündigen.