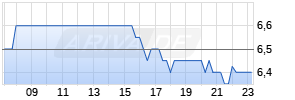

Titan International, Inc. Reports Third Quarter Financial Performance

PR Newswire

WEST CHICAGO, Ill., Nov. 1, 2023

Delivers solid profitability with EPS of $0.31, adjusted EPS of $0.29 and adjusted EBITDA of $41 million

Continued to drive strong operating cash flow and free cash flow of $51 million and $37 million, respectively

Company maintains full year 2023 outlook

WEST CHICAGO, Ill., Nov. 1, 2023 /PRNewswire/ -- Titan International, Inc. (NYSE: TWI) ("Titan" or the "Company"), a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, today reported results for the third quarter ended September 30, 2023.

Paul Reitz, President and Chief Executive Officer, stated, "Our One Titan team delivered another strong quarter by serving our customers well with market-leading products. One of the factors that sets Titan apart as a leader and partner of choice for off-the-road tires, wheels and undercarriage solutions is our emphasis on innovation. Farmers are increasingly relying on financial analysis as a key element of their decision making and with that in mind, innovative technologies such as our Low Sidewall, or LSW, offer them significant ROI. We first introduced our LSWs directly to end-users to prove to farmers that making the change they will find more than enough savings through improved fuel efficiency (up to 6%) and yield gains (up to 5%) to pay for the investment in these wheel/tire assemblies. Along with making more money, the improved comfort and performance of their equipment in difficult conditions results in a tremendous upgrade from standard wheel/tire set-ups. Our LSWs have definitively proven to our dealer partners, OEMs, and of course, everyone at Titan, that our LSW wheel/tire assemblies are a win-win for everyone."

Mr. Reitz continued, "Innovation is at the core of Titan and we are proud of the positive impact our products have on the end-users of Ag equipment. We will be soon taking that story to the airwaves via the documentary Viewpoint, featuring Dennis Quaid, that will highlight our innovation from the perspective of people that really understand the Ag market such as Tom and Jeff Sloan from Sloan Implement and the Stallings Family from Delta New Holland."

Mr. Reitz concluded, "We are positioned well to finish the year with good momentum and financial results that will rank as one of the best years in Titan's history. The operating and strategic plans we have put into action over recent years are accomplishing exactly what they were designed to do: mute the cyclicality of certain aspects of our business and drive performance when market conditions are volatile. It's well known that OEMs in the Ag sector significantly overstocked on wheels and tires, and I am especially satisfied in our ability to work through the industry destocking, which we expect will be substantially complete by year-end based on where customer order books currently stand, to drive solid financial performance. We are confident in our ability to finish 2023 with momentum to set the stage for continuing healthy financial results into the future. The mid and long-term demand picture for our products remains healthy in our end markets. Coupled with a balance sheet that allows us the flexibility to invest in our business, both organically and through tactical M&A, should the right opportunity arise, we are highly confident in Titan's long-term prospects."

ARIVA.DE Börsen-Geflüster

Aktie im Fokus

|

The Naga Group

0,96

€

+16,5%  |

Kurse

|

Full Year 2023 Outlook

The Company is maintaining its previously communicated outlook for FY 2023:

- Revenues are expected to range between $1.85 to $1.9 billion

- Adjusted EBITDA of $200 to $210 million

- Free cash flow to range between $110 to $120 million

- Capital expenditures to range between $55 to $60 million

David Martin, Chief Financial Officer, added, "As we head into year-end, our third quarter results have us on track for one of the best years in the history of the Company. In particular, our margins continue to be a bright spot, helping drive solid profitability and sustainable free cash flow generation."

Mr. Martin concluded, "That strong free cash flow has allowed us to continue fortifying our balance sheet while also returning capital to shareholders via our share repurchase program. During the third quarter, we generated $37 million of free cash flow, which allowed us to pay down $4 million of debt. We also used cash to repurchase just over one million additional shares during the quarter, at an average cost of $12.31. As of quarter-end, we had spent a total of $19 million under the Board authorized $50 million share repurchase program, and at the same time, increased our cash position to $212 million."

Results of Operations

Net sales for the third quarter ended September 30, 2023, were $401.8 million, compared to $530.7 million in the comparable quarter of 2022. Net sales change was primarily due to sales volume decrease caused by elevated inventory levels at our customers in the Americas, particularly OEM customers, lower levels of end customer demand in small agricultural equipment, and economic softness in Brazil. The net sales change was also impacted by negative price/mix from lower raw material costs and unfavorable currency translation of 1.1%.

Gross profit for the third quarter ended September 30, 2023, was $66.1 million, or 16.4% of net sales, compared to $87.6 million, or 16.5% of net sales, for the three months ended September 30, 2022. The decrease in gross profit was primarily due to the lower sales volume, while gross margin remained relatively flat period to period.

Selling, general and administrative expenses for the three months ended September 30, 2023 were $33.6 million, compared to $31.4 million for the three months ended September 30, 2022. The change in SG&A for the three months ended September 30, 2023 as compared to the prior year period was due to personnel related inflationary cost impacts.

Income from operations for the three months ended September 30, 2023 was $27.0 million, compared to income from operations of $50.5 million for the three months ended September 30, 2022. The decrease in income from operations was primarily due to lower net sales and the net result of the items previously discussed.

Segment Information

Agricultural Segment

| (Amounts in thousands, except percentages) | Three months ended | | Nine months ended | ||||||||

| | September 30, | | September 30, | ||||||||

| | 2023 | | 2022 | | % | | 2023 | | 2022 | | % |

| Net sales | $ 212,967 | | $ 289,259 | | (26.4) % | | $ 787,973 | | $ 917,443 | | (14.1) % |

| Gross profit | 37,026 | | 45,949 | | (19.4) % | | 135,012 | | 155,794 | | (13.3) % |

| Profit margin | 17.4 % | | 15.9 % | | 9.4 % | | 17.1 % | | 17.0 % | | 0.6 % |

| Income from operations | 21,383 | | 31,125 | | (31.3) % | | 86,071 | | 106,126 | | (18.9) % |

Net sales in the agricultural segment were $213.0 million for the three months ended September 30, 2023, as compared to $289.3 million for the comparable period in 2022. The net sales change was primarily due to actions taken by customers in North and South America to reduce elevated inventory levels, most notably OEM customers, overall softness in demand for small agricultural equipment, and decline in Brazilian economic activity. In addition, the change in net sales was due to negative price/product mix partly impacted by contractual price reductions to customers that are reflective of raw material and other input cost reductions, and an unfavorable impact of foreign currency translation of 3.6%.

Gross profit in the agricultural segment was $37.0 million for the three months ended September 30, 2023, as compared to $45.9 million in the comparable period in 2022. The change in gross profit was due to lower sales volume, which also resulted in lower fixed cost leverage. The increase in profit margin was due to actions taken to improve financial performance, including cost reductions and productivity initiatives executed across global operations in addition to lower production input costs.

Earthmoving/Construction Segment

| (Amounts in thousands, except percentages) | Three months ended | | Nine months ended | ||||||||

| | September 30, | | September 30, | ||||||||

| | 2023 | | 2022 | | % | | 2023 | | 2022 | | % |

| Net sales | $ 155,045 | | $ 199,921 | | (22.4) % | | $ 528,652 | | $ 611,550 | | (13.6) % |

| Gross profit | 22,257 | | 34,959 | | (36.3) % | | 88,583 | | 102,651 | | (13.7) % |

| Profit margin | 14.4 % | | 17.5 % | | (17.7) % | | 16.8 % | | 16.8 % | | — % |

| Income from operations | 8,501 | | 21,836 | | (61.1) % | | 46,561 | | 59,952 Werbung Mehr Nachrichten zur Titan International Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News | ||