Titan International, Inc. Reports First Quarter Financial Performance

PR Newswire

WEST CHICAGO, Ill., May 1, 2024

Delivers Solid Profitability with Adjusted EBITDA of $50 Million and Adjusted EPS of $0.29

Integration of Carlstar Driving 'One Stop Shop' Positioning in Ag and Consumer Segments for Long-Term growth

WEST CHICAGO, Ill., May 1, 2024 /PRNewswire/ -- Titan International, Inc. (NYSE: TWI) ("Titan" or the "Company"), a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, today reported financial results for the first quarter ended March 31, 2024. Results for the first quarter of 2024 include approximately one month of results from the February 29, 2024 acquisition of Carlstar Group LLC ("Carlstar").

Paul Reitz, President and Chief Executive Officer, stated, "The last two months have been very exciting for us as we have been running full speed integrating Carlstar into our existing operations. I have been particularly impressed by the enthusiasm I see from everyone at Titan and our new team members that joined us with the acquisition. One of the key strategic rationales for the acquisition was our expected ability to be a 'one stop shop' for customers by delivering best in class products with a deep portfolio for both aftermarket and OEM channels. From top to bottom, our employees understand this vision and are working hard every day to make it happen. We have made a lot of progress integrating Carlstar's operations and are very pleased by the initial feedback we've received from the market on the 'new Titan' and how that benefits our customers."

Mr. Reitz continued, "As we look towards the future, we believe Titan is positioned to deliver more consistent, stronger results throughout various market cycles due to the structural changes we have made in recent years and with the opportunities created by the Carlstar acquisition. We design and manufacture market leading products meeting the needs of customers that serve crucial mega-trend sectors of the global economy that, when combined with our long history of driving innovative products in the marketplace, provide us with long-term growth opportunities. Using that as a basis along with recent financial performance of Titan and Carlstar, along with expected synergies, we believe the combined companies in a typical year would have earnings power of $250 million to $300 million of adjusted EBITDA with free cash flow of at least $125 million. Our team is focused on implementing the short and long-term actions needed to deliver this and more, and while fiscal year 2024 results will be impacted by soft market conditions, it is good for our investors to have a perspective on the future opportunities and our steadfast focus on building shareholder value."

Mr. Reitz continued, "Turning to our first quarter, we were able to deliver solid results in the midst of challenging market conditions. Overall, all three of our sectors continue to be impacted by macro uncertainty, which is affecting many industries. Returning to our theme of 'controlling what we can control', during the first quarter we focused on our operating efficiency and other levers at our disposal to maximize our profitability. Gross margin was 16.7% on an adjusted basis, with Ag segment adjusted margins expanding to 17.2% from 16.1% a year ago. Consumer segment adjusted gross margin was 21.3%, up from 20.7% last year. Earthmoving/Construction adjusted gross margins lagged our other two segments at 14.0%, compared with 18.7%, as OEM volume declines in Europe and Latin America weighed on margins."

Mr. Reitz concluded, "The Titan team is experienced in handling market cycles and skilled at making timely decisions to adapt to evolving market conditions. We are seeing reduced OEM demand in all geographies and segments but remain confident that our end-markets are well supported by farmer incomes and balance sheets along with the global need for long-term infrastructure investments, so we don't expect a slowdown to be deep or protracted. We have seen tire and wheel inventory levels normalizing in the dealer channels, but overall sales levels are still running below our exceptional performance in 2022 and 2023. We expect sales activity within the Ag sector to be directly correlated with overall market activity in the first half of the year. Our Earthmoving/Construction segment continues to have a favorable long-term outlook despite the near-term volatility. With Carlstar contributing in full beginning with the second quarter of 2024, compared with only one month of contribution in Q1 2024, our Consumer segment sales now represent a more meaningful proportion of our total sales. While the consumer sector is facing some of the same macro headwinds as our other two segments, in the form of interest rate uncertainty, geopolitical instability and a looming Presidential election, we are encouraged by our new opportunities and the overall margin profile of the segment. Key to that is our aftermarket business, as that is less correlated to new equipment sales, along with sales synergies we expect to realize as a result of our one stop shop strategy. Titan remains in a strong position to succeed in capturing value due to the strength that we have created over the last several years."

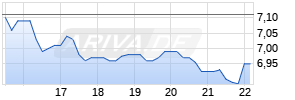

ARIVA.DE Börsen-Geflüster

Aktie im Fokus

|

The Naga Group

0,96

€

+16,5%  |

Kurse

|

Second Quarter 2024 Outlook

The Company is introducing financial guidance for Q2 2024 as follows:

- Revenues are expected to range between $525 million to $575 million

- SG&A plus royalty and R&D expense at approximately 11.0% of sales

- Adjusted EBITDA of $45 million to $55 million

- Free cash flow to range between $30 to $40 million

- Capital expenditures to range between $15 to $20 million

David Martin, Chief Financial Officer, added, "As Paul noted, macro uncertainty is acute right now, impacting our end markets as well as many others. With that in mind, we're providing guidance for the second quarter while the lack of adequate visibility leads us to refrain from giving full year guidance at this time. We are also including SG&A guidance as Carlstar's operating expense profile is different than Titan's, due to their distribution center model."

Mr. Martin concluded, "At quarter end our net debt was $370 million. That's in line with our modeling as we closed the Carlstar acquisition, and we expect to prioritize debt paydown as we move through the year. Based on our current integration progress, we expect to achieve bottom line synergies of $5 million to $6 million this year and $25 million to $30 million over the longer term. We will be opportunistic in allocating cash as we have approximately $15 remaining under the Board authorized $50 million share repurchase program. Our balance sheet strength and cash flow prospects set us up to create value over the long-term."

Results of Operations

Net sales for the three months ended March 31, 2024 were $482.2 million, compared to $548.6 million in the comparable period of 2023. Net sales changes were primarily attributed to the agricultural and earthmoving/construction segments. This was due to a decrease in sales volume caused by lower levels of end customer demand in agricultural equipment, and economic softness in Brazil. The volume change was positively impacted by the inclusion of net sales from the Carlstar acquisition for one month. It was also impacted by negative price due to lower raw material and other input costs, most notably steel, and unfavorable foreign currency translation of 2.3%.

Gross profit for the three months ended March 31, 2024 was $77.4 million, or 16.0% of net sales, compared to $95.6 million, or 17.4% of net sales, for the three months ended March 31, 2023. The changes in gross profit and gross margin for three months ended March 31, 2024 as compared to the prior year period were due to the lower sales, which resulted in lower fixed cost leverage. Excluding the impact of the inventory revaluation step-up associated with the Carlstar purchase price allocation of $3.4 million, gross profit was $80.7 million, or 16.7% of net sales.

Selling, general and administrative expenses for the three months ended March 31, 2024 were $39.4 million, or 8.2% of net sales, compared to $34.5 million, or 6.3% of net sales, for the three months ended March 31, 2023. The change in SG&A for the three months ended March 31, 2024 as compared to the prior year period was primarily due to recurring SG&A incurred on the Carlstar operations that includes management of distribution centers.

Acquisition related expenses for the three months ended March 31, 2024 were $6.2 million, associated with the transaction-related expenses for Carlstar.

Income from operations for the three months ended March 31, 2024 was $25.1 million, compared to income from operations of $55.1 million for the three months ended March 31, 2023. The change in income from operations for the three months ended March 31, 2024 as compared to the prior year periods was primarily due to lower net sales and the net result of the items previously discussed.

Segment Information

Agricultural Segment

| (Amounts in thousands, except percentages) | Three months ended | | ||||

| | March 31, | | ||||

| | 2024 | | 2023 | | % Increase / | |

| Net sales | $ 239,673 | | $ 305,858 | | (21.6) % | |

| Gross profit | 40,619 | | 49,250 | | (17.5) % | |

| Profit margin | 16.9 % | | 16.1 % | | 5.0 % | |

| Income from operations | 24,010 | | 32,569 | | (26.3) % | |

Net sales in the agricultural segment were $239.7 million for the three months ended March 31, 2024, as compared to $305.9 million for the comparable period in 2023. The net sales change was primarily attributed to lower sales volume in North and South America, resulting from overall softness in demand for agricultural equipment, and a decline in Brazilian economic activity. The change in net sales was also influenced by the unfavorable impact of foreign currency translation of 4.3%.

Gross profit in the agricultural segment was $40.6 million for the three months ended March 31, 2024, as compared to $49.3 million in the comparable period in 2023. The change in gross profit was attributed to lower sales volume. The increase in profit margin was due to the measures taken to improve financial performance, along with lower raw material and other input costs, which have helped offset the impact of lower fixed cost leverage.

Earthmoving/Construction Segment

| (Amounts in thousands, except percentages) | Three months ended | ||||

| | March 31, | ||||

| | 2024 | | 2023 | | % Decrease |

| Net sales | $ 165,208 | | $ 198,924 | | (16.9) % |

| Gross profit | 22,977 | | 37,224 | | (38.3) % |

| Profit margin | 13.9 % | | 18.7 % | | (25.7) % |

| Income from operations | 8,834 | | 23,538 | | (62.5) % |

The Company's earthmoving/construction segment net sales were $165.2 million for the three months ended March 31, 2024, as compared to $198.9 million in the comparable period in 2023. The change in earthmoving/construction sales was primarily due to lower sales volume in the Americas and the undercarriage business which was caused by a slowdown at construction OEM customers. In addition, the net sales change was impacted by negative price due to lower raw material and other input costs.

Gross profit in the earthmoving/construction segment was $23.0 million for the three months ended March 31, 2024, as compared to $37.2 million for the three months ended March 31, 2023. The changes in gross profit and margin were primarily attributed to the lower sales volume, which also resulted in lower fixed cost leverage and contractual price give backs due to lower steel prices, respectively.

Consumer Segment

| (Amounts in thousands, except percentages) | Three months ended | | ||||

| | March 31, | | ||||

| | 2024 | | 2023 | | % Increase / | |

| Net sales | $ 77,328 | | $ 43,862 | | 76.3 % | |

| Gross profit | 13,774 | | 9,083 | | 51.6 % | |

| Profit margin | 17.8 % | | 20.7 % | | (14.0) % | |

| Income from operations | 5,113 | | 6,792 | | (24.7) % | |

Consumer segment net sales were $77.3 million for the three months ended March 31, 2024, as compared to $43.9 million for the three months ended March 31, 2023. The increase in sales was driven by the positive effects of Carlstar acquisition, which contributed one month of results in the first quarter of 2024. The increase was partially offset by lower sales volumes, primarily in Americas, where demand was lower from the softer market conditions.

Gross profit from the consumer segment was $13.8 million for the three months ended March 31, 2024, as compared to $9.1 million for the three months ended March 31, 2023. The increase in gross profit was driven by the positive effects of the Carlstar acquisition. The change in profit margin was primarily due to the effect of the inventory revaluation step-up associated with the Carlstar purchase price allocation.

Non-GAAP Financial Measures

Adjusted EBITDA was $49.7 million for the first quarter of 2024, compared to $67.6 million in the comparable prior year period. The Company utilizes EBITDA and adjusted EBITDA, which are non-GAAP financial measures, as a means to measure its operating performance. A reconciliation of net income to EBITDA and adjusted EBITDA can be found at the end of this release.

Mehr Nachrichten zur Titan International Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.