HONEYWELL COMPLETES ACQUISITION OF CARRIER'S GLOBAL ACCESS SOLUTIONS BUSINESS AND UPDATES 2024 OUTLOOK

PR Newswire

CHARLOTTE, N.C., June 3, 2024

- $4.95 Billion Acquisition Bolsters Honeywell's Strategic Alignment to the Automation Megatrend, Underpinned by Digitalization

- Positions Honeywell as a Leading Provider of Security Solutions in a Digital Age

- Enhances Honeywell's Building Automation Segment, Adding an Accretive Growth and Margin Business

CHARLOTTE, N.C., June 3, 2024 /PRNewswire/ -- Honeywell (NASDAQ: HON) today announced the completion of its acquisition of Carrier Global Corporation's (NYSE: CARR) Global Access Solutions business for $4.95 billion. The deal positions Honeywell as a leading provider of security solutions for the digital age with opportunities for accelerated innovation in the fast-growing, cloud-based services and solutions space. This transaction also strengthens Honeywell's alignment of its portfolio around three compelling megatrends, including automation, and complements Honeywell's Building Automation segment.

The acquisition brings differentiated software capabilities through the addition of three respected brands to Honeywell's portfolio: LenelS2, a leader in commercial and enterprise access solutions; Onity, which offers electronic locks, specifically hospitality access and mobile credentials; and Supra, which specializes in cloud-based electronic lockboxes and scheduling software. Global Access Solutions' approximately 1,200 employees are now part of Honeywell. The transaction is expected to be adjusted earnings per share1 accretive in the first full year of ownership.

Global Access Solutions enhances Honeywell's Building Automation business model of leading with high-value products that are critical for buildings. Honeywell will also benefit from the business's attractive growth and margin profile, valuable software content, and accretive mix of recurring revenue, with forecasted annual sales in excess of $1 billion when combined with Honeywell's existing security portfolio.

"As the world's security needs evolve from a focus on protecting people to protecting both people and critical assets, we see strong growth prospects for our Access Solutions acquisition," said Vimal Kapur, Chief Executive Officer of Honeywell. "By building on our strong track record of delivering high-value building automation products, solutions, and services globally, this acquisition creates an exciting opportunity for us to achieve faster growth and further margin expansion, while generating better outcomes for our Building Automation customers."

Company Updates 2024 Outlook, Changes Non-GAAP Reporting Metrics

Beginning in the second quarter, Honeywell will exclude the impact of amortization expense for acquisition-related intangible assets and other acquisition-related costs4, including the related tax effects, from segment profit1 and adjusted earnings per share1. The company believes this change provides investors with a more meaningful measure of its performance period to period, aligns the measure to how management will evaluate performance internally, and makes it easier for investors to compare our performance to peers. Honeywell plans to provide historical non-GAAP financials under this new basis to facilitate comparability when the company reports its second quarter results in July 2024.

As a result of the acquisition closing, Honeywell has updated its full-year sales, segment margin2, and adjusted earnings per share2,3 guidance (under the amended calculation). Full-year sales are now expected to be $38.5 billion to $39.3 billion, including organic1 sales growth of 4% to 6%. Segment margin2 is expected to be in the range of 23.8% to 24.1%, with segment margin expansion2 of 30 to 60 basis points. Adjusted earnings per share2,3 is expected to be in the range of $10.15 to $10.45. Operating cash flow is expected to be in the range of $6.7 billion to $7.1 billion, with free cash flow1 of $5.6 billion to $6.0 billion. A summary of the changes to the company's full-year guidance can be found in Table 1.

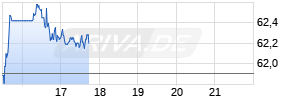

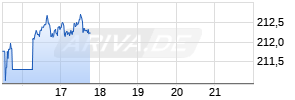

ARIVA.DE Börsen-Geflüster

Kurse

|

|

Honeywell also updated its second-quarter sales, segment margin2, and adjusted earnings per share2,3 guidance. Second-quarter sales are expected to be $9.3 billion to $9.6 billion, with organic1 sales growth of 1% to 4%. Segment margin2 is expected to be 22.7% to 23.1%, down 40 basis points to flat compared to the prior year period. Adjusted earnings per share2,3 is expected to be in the range of $2.35 to $2.45, up 2% to 7% compared to the prior year.

TABLE 1: FULL-YEAR 2024 GUIDANCE

| | Previous Guidance | Impact of | Guidance After the | Impact of Non- | Updated Guidance |

| Sales | $38.1B - $38.9B | ~$0.4B | $38.5B - $39.3B | — | $38.5B - $39.3B |

| Organic1 Growth | 4% - 6% | — | 4% - 6% | — | 4% - 6% |

| Segment Margin2 | 23.0% - 23.3% | (0.2) % | 22.8% - 23.1% | 1.0 % | 23.8% - 24.1% |

| Expansion2 | Up 30 - 60 bps | (20 bps) | Up 10 - 40 bps | 20 bps | Up 30 - 60 bps |

| Adjusted Earnings Per Share2,3 | $9.80 - $10.10 | ($0.15) | $9.65 - $9.95 | $0.50 | $10.15 - $10.45 |

| Adjusted Earnings Growth2,3 | 7% - 10% | (1 %) | 6% - 9% | 1 % | 7% - 10% |

| Operating Cash Flow | $6.7B - $7.1B | — | $6.7B - $7.1B | — | $6.7B - $7.1B |

| Free Cash Flow1 | $5.6B - $6.0B | — | $5.6B - $6.0B | — | $5.6B - $6.0B |

| 1 | | See additional information at the end of this release regarding non-GAAP financial measures. |

| 2 | | Segment margin and adjusted EPS are non-GAAP financial measures. Management cannot reliably predict or estimate, without unreasonable effort, the impact and timing on future operating results arising from certain items excluded from segment margin or adjusted EPS. We therefore, do not present a guidance range, or a reconciliation to, the nearest GAAP financial measures of operating margin or EPS. |

| 3 | | Adjusted EPS and adjusted EPS V% guidance excludes items identified in the non-GAAP reconciliation of adjusted EPS at the end of this release, including the impact of amortization expense for acquisition-related intangible assets and other acquisition-related costs, and any potential future items that we cannot reliably predict or estimate such as pension mark-to-market. |

| 4 | | Acquisition-related costs are principally comprised of third-party transaction and integration costs and acquisition-related fair value adjustments to inventory. |

Honeywell is an integrated operating company serving a broad range of industries and geographies around the world. Our business is aligned with three powerful megatrends - automation, the future of aviation, and energy transition - underpinned by our Honeywell Accelerator operating system and Honeywell Connected Enterprise integrated software platform. As a trusted partner, we help organizations solve the world's toughest, most complex challenges, providing actionable solutions and innovations that help make the world smarter, safer, and more sustainable. For more news and information on Honeywell, please visit www.honeywell.com/newsroom.

Honeywell uses our Investor Relations website, www.honeywell.com/investor, as a means of disclosing information which may be of interest or material to our investors and for complying with disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website, in addition to following our press releases, SEC filings, public conference calls, webcasts, and social media.

We describe certain trends and other factors that drive our business and future results in this release. Such discussions contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). Forward-looking statements are those that address activities, events, or developments that management intends, expects, projects, believes or anticipates will or may occur in the future. They are based on management's assumptions and assessments in light of past experience and trends, current economic and industry conditions, expected future developments and other relevant factors, many of which are difficult to predict and outside of our control. They are not guarantees of future performance, and actual results, developments and business decisions may differ significantly from those envisaged by our forward-looking statements. We do not undertake to update or revise any of our forward-looking statements, except as required by applicable securities law. Our forward-looking statements are also subject to material risks and uncertainties, including ongoing macroeconomic and geopolitical risks, such as lower GDP growth or recession, capital markets volatility, inflation, and certain regional conflicts, that can affect our performance in both the near- and long-term. In addition, no assurance can be given that any plan, initiative, projection, goal, commitment, expectation, or prospect set forth in this release can or will be achieved. These forward-looking statements should be considered in light of the information included in this release, our Form 10-K and other filings with the Securities and Exchange Commission. Any forward-looking plans described herein are not final and may be modified or abandoned at any time.

This release contains financial measures presented on a non-GAAP basis. Honeywell's non-GAAP financial measures used in this release are as follows:

- Segment profit, on an overall Honeywell basis;

- Segment profit margin, on an overall Honeywell basis;

- Organic sales growth;

- Free cash flow; and

- Adjusted earnings per share.

Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. Management believes the change to adjust for amortization of acquisition-related intangibles and acquisition-related costs provides investors with a more meaningful measure of its performance period to period, aligns the measure to how management will evaluate performance internally, and makes it easier for investors to compare our performance to peers. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. Certain measures presented on a non-GAAP basis represent the impact of adjusting items net of tax. The tax-effect for adjusting items is determined individually and on a case-by-case basis. Refer to the Appendix attached to this release for reconciliations of non-GAAP financial measures to the most directly comparable GAAP measures. Honeywell plans to provide historical non-GAAP financials under this new basis to facilitate comparability when the company reports its second quarter results in July 2024.

Appendix

Non-GAAP Financial Measures

The following information provides definitions and reconciliations of certain non-GAAP financial measures presented in this press release to which this reconciliation is attached to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). Honeywell plans to provide historical non-GAAP financials under this new basis to facilitate comparability when the company reports its second quarter results in July.

Management believes that, when considered together with reported amounts, these measures are useful to investors and management in understanding our ongoing operations and in the analysis of ongoing operating trends. Management believes the change to adjust for amortization of acquisition-related intangibles and acquisition-related costs provides investors with a more meaningful measure of its performance period to period, aligns the measure to how management will evaluate performance internally, and makes it easier for investors to compare our performance to peers. These measures should be considered in addition to, and not as replacements for, the most comparable GAAP measure. Certain measures presented on a non-GAAP basis represent the impact of adjusting items net of tax. The tax-effect for adjusting items is determined individually and on a case-by-case basis. Other companies may calculate these non-GAAP measures differently, limiting the usefulness of these measures for comparative purposes.

Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitations of these non-GAAP financial measures are that they exclude significant expenses and income that are required by GAAP to be recognized in the consolidated financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. Investors are urged to review the reconciliation of the non-GAAP financial measures to the comparable GAAP financial measures and not to rely on any single financial measure to evaluate Honeywell's business.

Honeywell International Inc.

Definition of Organic Sales % Change

We define organic sales percentage as the year-over-year change in reported sales relative to the comparable period, excluding the impact on sales from foreign currency translation and acquisitions, net of divestitures, for the first 12 months following the transaction date. We believe this measure is useful to investors and management in understanding our ongoing operations and in analysis of ongoing operating trends.

A quantitative reconciliation of reported sales percent change to organic sales percent change has not been provided for forward-looking measures of organic sales percent change because management cannot reliably predict or estimate, without unreasonable effort, the fluctuations in global currency markets that impact foreign currency translation, nor is it reasonable for management to predict the timing, occurrence and impact of acquisition and divestiture transactions, all of which could significantly impact our reported sales percent change.

Honeywell International Inc.

Reconciliation of Operating Income to Segment Profit, Calculation of Operating Income and Segment Profit Margins

(Unaudited)

(Dollars in millions)

Beginning second quarter 2024, we will exclude the impact of amortization expense for acquisition-related intangible assets and certain acquisition-related costs from segment profit. The table below reconciles historical operating income to segment profit and segment profit margin giving effect to the additional adjustments.

| | Three Months Ended | | Twelve Months Ended |

| | 2023 | | 2023 |

| Operating income | $ 1,883 | | $ 7,084 |

| Stock compensation expense1 | 50 | | 202 Werbung Mehr Nachrichten zur Honeywell International Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. |