29 September 2009

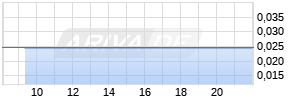

AIM / PLUS Markets: AAU

HALF-YEARLY REPORT FOR SIX MONTHS TO 30 JUNE 2009

Ariana Resources plc ("Ariana" or "the Company"), the gold

exploration and development company focused on Turkey, announces its

unaudited half-yearly results for the six months ended 30 June 2009.

Highlights:

* Trial mining on Kiziltepe; first gold production

* Acquisition of the Muratdag Gold Project

* 401,000 oz Au equivalent in JORC resources

* JV discovery of the Salinbas Prospect

Dr. Kerim Sener, Managing Director, commented:

"During the period the Company made important strides towards the

development of its projects in western Turkey. The trial mining of

the Kiziltepe deposit demonstrated the Company's ability to deliver

on its operational targets, both on time and on budget. With a

combined JORC resource of over 401,000 oz gold equivalent across the

Kiziltepe and Tavsan deposits, the Company is now well placed to

pursue development routes which capitalise on current elevated gold

prices.

We announced recently the combination of Kiziltepe and Tavsan into a

single conceptual entity known as the Red Rabbit Project. The

Company is considering a joint venture (JV) on Red Rabbit with a

Turkish engineering firm. Such a JV will encompass the necessary

feasibility work, environmental impact assessment, engineering design

and plant construction required for the advancement of Red Rabbit.

In north-eastern Turkey, our JV with European Goldfields has made

several significant discoveries. The identification of additional

potential in the Ardala South area, the nearby discovery of the

high-grade Salinbas Prospect and continued increases in ground

holding in this area highlight the value of the JV.

At the beginning of a year of unprecedented market uncertainty, the

Company raised £500,000 with the support of its largest

shareholders. Underpinned by improving market sentiment post-period,

the Company successfully raised a further £800,000, which will be

devoted to funding the Company through the early stages of its

development work on the Red Rabbit Project and to enable focused

exploration on Kiziltepe and Tavsan."

CHAIRMAN'S STATEMENT

Although we entered this year with markets clouded by global

macroeconomic uncertainty, the Company actively took the decision to

follow through with its immediate objectives in western Turkey.

After establishing over 401,000 oz Au in JORC resources and the

completion of necessary permitting at Kiziltepe towards the end of

last year, the Company began trial mining at this location and

produced its first gold. The achievement of this significant

milestone resulted in a further reappraisal of our two principal

projects: Kiziltepe and Tavsan. Both projects are now being

evaluated and advanced under the banner of the Red Rabbit Project.

Meanwhile our Joint Venture with European Goldfields Limited in the

vicinity of the Ardala copper-gold porphyry in north eastern Turkey

is providing encouraging exploration success.

Red Rabbit Project

The conceptual combination of the Kiziltepe and Tavsan projects into

a single integrated project - named 'Red Rabbit' - creates a

potentially economic 230,000 oz Measured and Indicated and 170,000 oz

Inferred JORC resource. Excluding the existing Inferred resources,

the combined project satisfies a production rate of 30,000 oz per

annum over a period of 7 years. Further exploration at both

Kiziltepe and Tavsan is planned with the object of increasing the

combined resource base to at least 500,000 oz.

Based on the conceptual project outline, the Company envisages mining

high-grade ore from Kiziltepe and trucking this material 125km by

road to Tavsan. The Tavsan deposit would itself be mined and

processed at a heap-leach facility established on site. Low-grade

ore from Tavsan would be blended with the high-grade ore arriving

from Kiziltepe before being placed on the heap-leach pads. In the

same context, the Company will consider the development of the

combined project via the staged mining of Kiziltepe and Tavsan, with

mining commencing at the high-grade Kiziltepe deposit and concluding

with the mining of the low grade Tavsan deposit.

The Company intends to pursue components of a feasibility study for

the Red Rabbit Project during Quarter 4, 2009. The most critical

aspect of this is the metallurgical testwork required to determine

the optimal crush size of Kiziltepe and Tavsan ore with respect to

cost and recovery. Following this, the Company intends to progress

the project rapidly through to feasibility in 2010 by undertaking

comprehensive column leach testwork, preliminary mine design and

economic modelling.

In parallel with these efforts to bring the project to feasibility,

the Company is considering a joint venture with a Turkish engineering

company to fast-track the project through feasibility and ultimately

onto production. Renewed exploration in the area between Kiziltepe

and Tavsan has also begun, with the aim of identifying further

resource potential in this highly prospective region.

Joint Venture

Our Joint Venture with European Goldfields Limited in north-eastern

Turkey is continuing to yield exploration success. At the Ardala

Project, exploration has confirmed that porphyry Cu-Au mineralisation

continues to the south of previously mapped and drilled outcrops.

Modelling of the newly discovered zone is now complete and

drill-testing is planned.

Approximately 1.5km to the southwest of the main Ardala porphyry, a

higher-grade gold zone named the Salinbas prospect has been

identified by rock-chip and soil sampling. Detailed mapping and

lithological sampling has identified a 230 metre long zone of breccia

showing widths of 5 to 15 metres. Rock-chip samples returned grades

of between 1.42 and 20.5 g/t Au with an average of 10.8 g/t Au.

Other high-grade but more sporadic occurrences are located along

strike and parallel to this principal zone of interest. A programme

of trenching with follow-up drilling is due to commence on this

prospect in the near future.

The JV is consolidating its ground holding in this part of the

Pontide metallogenic belt and in several newly defined areas, with

the aim of undertaking modern, systematic exploration for porphyry

Cu-Au and related Au mineralisation. Ariana currently retains 49% of

the JV and European Goldfields is continuing to fund exploration and

development of the JV licences.

Outlook

As a focused gold exploration and development Company, our objectives

have not changed: we remain committed to establishing economic gold

resources in Turkey and then to develop these resources in the

shortest timeframe possible. Over the past five years we have

established the Company as one of the leading gold explorers

operating in Turkey. In this period, we have built up considerable

geological and operational expertise within what is currently the

most productive gold province in Europe. We are committed to

maintaining this strategic position, and are on the threshold of

important development and production decisions.

Michael Spriggs

Chairman

29 September 2009

Contacts:

Ariana Resources plc Tel: 020 7407 3616

Michael Spriggs, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: 020 7628 3396

Roland Cornish

Alexander David Securities Limited Tel: 020 7448 9820

Nick Bealer / David Scott

Loeb Aron & Company Ltd Tel: 020 7628 1128

Peter Freeman / Frank Lucas

Editors' note:

About Ariana Resources

Ariana is an exploration and development company focused on

epithermal gold-silver and porphyry copper-gold deposits in Turkey.

The Company is exploring a portfolio of prospective licences selected

on the basis of its in-house geological and remote-sensing database,

on its own in western Turkey and in Joint Venture with European

Goldfields Limited in north-eastern Turkey.

The Company's flagship assets are its Sindirgi and Tavsan gold

projects. Both projects contain a series of prospects, within two

prolific mineralised districts in the Western Anatolian Volcanic and

Extensional (WAVE) Province in western Turkey. This Province hosts

the largest operating gold mines in Turkey and remains highly

prospective for new porphyry and epithermal deposits. These core

projects, which are separated by a distance of 75km, are presently

being assessed as to their economic merits. The total resource

inventory of the Company stands at 401,000 ounces of gold

equivalent.

Loeb Aron & Company Ltd. and Alexander David Securities Limited are

joint brokers to the Company and Beaumont Cornish Limited is the

Company's Nominated Adviser.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com.

Ends

Ariana Resources Plc

Unaudited condensed consolidated interim statement of comprehensive

income

For the six months ended 30 June 2009

12 months to

Note 6 months to 6 months to 31 December

30 June 30 June 2008

2009 2008

Continuing

Operations £'000 £'000 £'000

Administrative

costs (206) (343) (608)

Other income 12 - -

Operating Loss (194) (343) (608)

Share of loss (2)

of associates - (25)

Investment

income 3 18 29

Loss on

ordinary (327)

activities

before tax for

the period (191) (604)

Tax (3) - - -

Loss for the

period (191) (327) (604)

Other

comprehensive

income:

Exchange

differences on

translating (23)

foreign

operations (40) 25

Other

comprehensive

income for the (23)

period, net of

tax (40) 25

Total

comprehensive (350)

income for the

period (231) (579)

Loss for the

period (327)

attributable

to

Owners of the

parent (191) (604)

Total

comprehensive

income

attributable (350)

to:

Owners of the

parent (231) (579)

Loss per share (pence):

Basic

(4) 0.14 0.41 0.71

_____ _____ _____

Diluted

0.13 0.41 0.71

_____ _____ _____

Condensed consolidated balance sheet

30 June 30 June 2008 31 December

2009 2008

£'000 £'000 £'000

ASSETS

Non-current assets

Trade and other 179

receivables 126 126

Land, property, plant 267

and equipment 213 230

Intangible assets 3,711 3,064 3,401

Interest in associates - 24 -

Total non-current assets 4,050 3,534 3,757

Current assets

Trade and other

receivables 174 214 302

Cash and cash

equivalents 198 671 143

Total current assets 372 885 445

Total assets 4,422 4,419 4,202

Equity

Called up share capital 1,427 927 927

Share premium 4,244 4,282 4,282

Other reserves 720 720 720

Share options 100 85 100

Translation reserve 23 15 63

Retained earnings (2,237) (1,769) (2,046)

Total equity 4,277 4,260 4,046

Liabilities

Current liabilities

Trade and other payables 145 159 156

Total current

liabilities 145 159 156

Total equity and 4,419

liability 4,422 4,202

Condensed consolidated interim cash flow statement

6 months to 6 months to 12 months to

30 June 30 June 31 December

2009 2008 2008

£'000 £'000 £'000

Cash flows from operating

activities

Cash generated from operations (100) (363) (613)

Net cash outflow from

operations (100) (363) (613)

Cash flows from investing

activities

Purchase of land, property,

plant and equipment - (231) (231)

Purchase of an interest in (26)

associate - (25)

Purchase of intangible assets (310) (832) (1,125)

Interest received 3 14 28

Net cash used in investing

activities (307) (1,075) (1,353)

Cash flows from financing

activities

Proceeds from issue of share

capital 462 927 927

Net cash proceeds from

financing activities 462 927 927

Net increase/(decrease) in

cash and cash equivalents 55 (511) (1,039)

Cash and cash equivalents at

beginning of period 143 1,182 1,182

Cash and cash equivalents at 671

end of period 198 143

Notes

Ariana Resources Plc

Notes to the unaudited consolidated interim financial statements

For the six months ended 30 June 2009

1. General information

Ariana Resources Plc (the "Company") is a public limited company

incorporated and domiciled in Great Britain. The addresses of its

registered office and principal place of business are disclosed at

the end of this report. The Company's shares are listed on the

Alternative Investment Market of the London stock Exchange. The

principal activities of the Company and its subsidiaries (the

"Group") are related to the exploration for and development of gold

and other minerals in Turkey.

The unaudited consolidated interim financial statements are presented

in Pounds Sterling (£), which is the parent company's functional and

presentation currency, and all values are rounded to the nearest

thousand except where otherwise indicated.

The financial information set out in this interim report does not

constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2008, prepared under IFRS, have been filed

with the Registrar of Companies. The auditor's report on those

financial statements was unqualified and did not contain a statement

under Section 237(2) of the Companies Act 1985.

1(a). Basis of preparation

These financial statements have been prepared under the historical

cost convention, and the accounting policies have been applied

consistently throughout the Group for the purposes of preparation of

these condensed consolidated interim financial statements.

The financial information for the twelve months ended 31 December

2008 has been derived from the Group's audited financial statements

for the period as filed with the Registrar of Companies. It does not

constitute the financial statements for that period. The auditor's

report on the statutory financial statements for the year ended 31

December 2008 was unqualified and did not contain any statement under

Section 237(2) or (3) of the Companies Act 1985.

The amendment to IAS1 (Revised) Presentation of Financial Statements

released in September 2007 redefines the primary statements and

expands on certain disclosures within these. The group's primary

statements have been amended to reflect the presentation required and

the adoption of this amendment has had no impact on Group earnings or

equity in the current or prior periods

New IFRS accounting standards and interpretations not yet adopted

The directors together with their advisers are in the process of

evaluating the impact of standards and interpretations that have not

yet become effective. Listed below are those standards and

interpretations most likely to impact the Group:

- IAS 23 Borrowing Costs (revised 2007) (effective 1 January 2009)

- IAS 27 Consolidated and Separate Financial Statements (Revised

2008) (effective 1 July 2009)

- Amendment to IFRS 2 Share-based Payment - Vesting Conditions and

Cancellations (effective 1 January 2009)

- IFRS 3 Business Combinations (Revised 2008) (effective 1 July 2009)

- IFRS 8 Operating Segments (effective 1 January 2009)

- IFRIC 11 IFRS 2 - Group and Treasury Share Transactions (effective

1 March 2007)

IFRS 8 Operating Segments replaces the segmental reporting

requirements of IAS 14 Segment Reporting. The key change is to align

the determination of segments in the financial statements with that

used by management in their resource allocation decisions. This

standard is not expected to have significant impact on existing

disclosure

Based on the Group's current business model and accounting policies

it is felt that the other standards and/or interpretations are

unlikely to have a material impact on the Group's earnings or

shareholders' funds.

IFRS 1 First time adoption of IFRS: the Group has elected the

business combinations exemption, which allows the Company not to

restate business combinations prior to 1 January 2006.

The Group has elected to apply the transitional provisions under IFRS

6 which permits the existing accounting policy under UK GAAP for

accounting for and capitalisation of mineral exploration costs, to be

used for IFRS purposes.

The Group has chosen not to restate items of property, plant and

equipment to fair value at the transition date.

1(b). Significant accounting policies

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company.

Control is achieved where the Company has the power to govern the

financial and operating policies of an entity so as to obtain

benefits from its activities.

The results of subsidiaries and associates acquired or disposed of

are included in the consolidated income statement from the effective

date of acquisition or up to the effective date of disposal, as

appropriate.

Where necessary, adjustments are made to the financial statements of

subsidiaries to bring their accounting policies into line with those

used by other members of the Group. All intra-group transactions,

balances, income and expenses are eliminated in full on

consolidation.

Income and expense recognition

The Group's only income is interest receivable from bank deposits.

Interest income is accrued on a time basis, by reference to the

principal outstanding and the effective rate of interest applicable.

The effective interest rate is the rate that exactly discounts

estimated future cash receipts through the expected life of the

financial asset to the net carrying amount of the financial asset.

Operating expenses are recognised in the income statement upon

utilisation of the service or at the date of their origin and are

reported on an accruals basis.

Group companies

The results and financial position of all the Group entities (none of

which has the currency of a hyperinflationary economy) that have a

functional currency different from the presentation currency are

translated into the presentation currency as follows:

- monetary assets and liabilities for each balance sheet

presented are translated at the closing rate at the date of that

balance sheet. Non-monetary items are measured at the exchange rate

in effect at the historical transaction date and are not translated

at each balance sheet date.

- income and expenses for each income statement

are translated at average exchange rates (unless this average is not

a reasonable approximation of the cumulative effect of the rates

prevailing on the transaction dates, in which case income and

expenses are translated at the dates of the transaction); and

- all resulting exchange differences are recognised as

a separate component of equity. On consolidation, exchange

differences arising from the translation of monetary items receivable

from foreign subsidiaries for which settlement is neither planned nor

likely to occur in the foreseeable future are taken to shareholders'

equity. When a foreign operation is sold, such exchange differences

are recognised in the income statement

as part of the gain or loss on sale.

Investments in associates

An associate is an entity over which the Group is in a position to

exercise significant influence, but not control or joint control,

through participation in the financial and operating policy decisions

of the investee. Significant influence is the power to participate in

the financial and operating policy decisions of the investee but is

not control or joint control over those policies.

The results and assets and liabilities of associates are incorporated

in these financial statements using the equity method of accounting

except when classified as held for sale. Investments in associates

are carried in the balance sheet at cost as adjusted by

post-acquisition changes in the Group`s share of the net assets of

the associate, less any impairment in the value of individual

investments. Losses of the associates in excess of the Group`s

interest in those associates are not recognised.

Intangible assets

Intangible assets represent the cost of acquisition by the Group of

rights, licences and know how. Such expenditure requires the

immediate write-off of exploration and development expenditure that

the Directors do not consider to be supported by the existence of

commercial reserves.

All costs associated with mineral exploration and investments are

capitalised on a project-by-project basis, pending determination of

the feasibility of the project. Costs incurred include appropriate

technical and administrative expenses but not general overheads. If

an exploration project is successful, the related expenditures will

be transferred to mining assets and amortised over the estimated life

of the commercial ore reserves on a unit of production basis. Where a

licence is relinquished or a project abandoned, the related costs are

written off. Where the Group maintains an interest in a project, but

the value of the project is considered to be impaired, a provision

against the relevant capitalised costs will be raised.

The recoverability of all exploration and development costs is

dependent upon the discovery of economically recoverable reserves,

the ability of the Group to obtain necessary financing to complete

the development of reserves and future profitable production or

proceeds from the disposition thereof.

Impairment of tangible and intangible assets

At each balance sheet date, the Group reviews the carrying amounts of

its tangible and intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If any

such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss (if

any). Where it is not possible to estimate the recoverable amount of

an individual asset, the Group estimates the recoverable amount of

the cash-generating unit to which the asset belongs. Where a

reasonable and consistent basis of allocation can be identified,

corporate assets are also allocated to individual cash-generating

units, or otherwise they are allocated to the smallest group of

cash-generating units for which a reasonable and consistent

allocation basis can be identified.

Intangible assets with indefinite useful lives and intangible assets

not yet available for use are tested for impairment annually, and

whenever there is an indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to sell and

value in use. In assessing value in use, the estimated future cash

flows are discounted to their present value using a pre-tax discount

rate that reflects current market assessments of the time value of

money and the risks specific to the asset for which the estimates of

future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is

estimated to be less than its carrying amount, the carrying amount of

the asset (cash-generating unit) is reduced to its recoverable

amount. An impairment loss is recognised immediately in the income

statement, unless the relevant asset is carried at a revalued amount,

in which case the impairment loss is treated as a revaluation

decrease.

Where an impairment loss subsequently reverses, the carrying amount

of the asset (cash-generating unit) is increased to the revised

estimate of its recoverable amount, but so that the increased

carrying amount does not exceed the carrying amount that would have

been determined had no impairment loss been recognised for the asset

(cash-generating unit) in prior years. A reversal of an impairment

loss is recognised immediately in the income statement, unless the

relevant asset is carried at a revalued amount, in which case the

reversal of the impairment loss is treated as a revaluation increase.

2. Accounting estimates and judgements

The Group makes estimates and assumptions regarding the future.

Estimates and judgements are continually evaluated based on

experience and other factors, including expectations of future events

that are believed to be reasonable under the circumstances. In the

future, actual experience may deviate from these estimates and

assumptions. The estimates and assumptions that have a significant

risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next financial year are discussed

below:

* Capitalised mining costs

The recovery of the value of the Group's exploration

mining projects is reviewed in the light of future production

estimates based upon ongoing geological studies. Over the longer term

the actual mineable resources achieved may vary significantly from

the current estimates. The Group periodically updates estimates of

resources in respect of its exploration mining projects and assesses

those for indicators of impairment relating to its capitalised costs.

* Carrying value of property, plant and equipment

The Group monitors internal and external indicators of impairment

relating to its property, plant and equipment. Management has

considered whether any indicators of impairment have arisen over

certain assets. After assessing these, management has concluded that

no impairment has arisen in respect of these assets during the period

and subsequently.

* Useful lives of tangible assets

Plant and equipment are depreciated over their useful lives. Useful

lives are based on management's estimates and are periodically

reviewed for continued appropriateness.

* Fair value of financial instruments

The Group determines the fair value of financial instruments that are

not quoted, based on estimates using present values or other

valuation techniques. Those techniques are significantly affected by

the assumptions used, including discount rates and estimates of

future cash flows.

* Share-based payments

In order to calculate the charge for share-based payments

as required by IFRS 2, the Group makes estimates principally relating

to assumptions used in its option-pricing model as set out in note11.

* Shareholder warrants

The shareholder warrants entitle shareholders to a number

of common shares based upon the number of shares they subscribed for

at the date of issue of the warrant instrument. The warrants relate

to a transaction with the equity holders as opposed to a transaction

in exchange for any goods or service. The equity component of the

instrument is not considered material and there is no liability

component arising as a result of these warrants. Upon exercise of the

warrant the proceeds received, net of attributable transaction costs,

are credited to share capital and where appropriate share premium.

* Trade and other receivables

Trade and other receivables are recognised initially at

fair value and subsequently restated for any impairment. A provision

for impairment of trade receivables is established when there is

objective evidence that the Group will not be able to collect all

amounts due according to the original terms of the receivables.

3. Tax

The Group has incurred tax losses for the period and a corporation

tax charge is not anticipated.

4. Loss per share

The calculation of basic loss per share is based on the loss

attributable to ordinary shareholders of £191,000 divided by the

weighted average number of shares in issue during the period, being

139,263,918 (fully diluted weighted average number of share amounts

to 145,760,462).

The full Half-Yearly-Report is published on the Company's website:

www.arianaresources.com.

---END OF MESSAGE---

This announcement was originally distributed by Hugin. The issuer is

solely responsible for the content of this announcement.

Top-News

Half-yearly report for six months to 30 June 2009

Dienstag, 29.09.2009 08:05 von Hugin - Aufrufe: 164

Werbung

Mehr Nachrichten kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

-1

Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink.

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.