Darling Ingredients Inc. Reports Third Quarter 2023 Results

PR Newswire

IRVING, Texas, Nov. 7, 2023

Third Quarter 2023

- Net income of $125.0 million, or $0.77 per GAAP diluted share

- Net sales of $1.6 billion

- Combined adjusted EBITDA of $334.3 million

- Global ingredients business EBITDA of $247.8 million

- Received $62.2 million in cash dividends from Diamond Green Diesel

IRVING, Texas, Nov. 7, 2023 /PRNewswire/ -- Darling Ingredients Inc. (NYSE: DAR) today reported net income of $125.0 million, or $0.77 per diluted share for third quarter of 2023, compared to net income of $191.1 million, or $1.17 per diluted share, for third quarter of 2022. The company also reported net sales of $1.6 billion for the third quarter of 2023, compared with net sales of $1.7 billion for the same period a year ago.

"Our core business continues to perform extremely well. We had seasonally strong performance during the third quarter and were able to return gross margins to pre-acquisition levels," said Randall C. Stuewe, Darling Ingredients Chairman and Chief Executive Officer. "The company has good momentum as we close out the year and is well positioned heading into 2024."

For the nine months ended Sept. 30, 2023, Darling Ingredients reported net sales of $5.2 billion, compared to net sales of $4.8 billion for the same period in 2022. Net income for the first nine months of 2023 was $563.2 million, or $3.47 per diluted share, as compared to net income of $581.1 million, or $3.54 per diluted share, for the first nine months of 2022.

Diamond Green Diesel (DGD) sold 266.8 million gallons of renewable diesel for the third quarter 2023 at an average of $0.65 per gallon EBITDA. Year-to-date, DGD has sold 910.0 million gallons of renewable diesel at an average of $1.02 per gallon EBITDA. During the third quarter, Darling Ingredients received $62.2 million in cash dividends from the joint venture, and $163.6 million in cash dividends year to date.

"Extreme volatility in the global petroleum market and swift declines in RINs and LCFS prices created headwinds in our Fuel business during 3Q," Stuewe said. "A recent decline in fat prices have shown that new renewable diesel capacity is not coming on line as soon as projected. Despite these headwinds, DGD is still performing above investment case returns."

ARIVA.DE Börsen-Geflüster

Aktie im Fokus

|

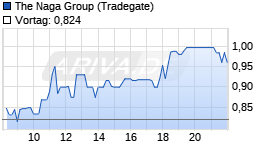

The Naga Group

0,96

€

+16,5%  |

Kurse

|

Combined adjusted EBITDA for the third quarter 2023 was $334.3 million, compared to $394.7 million for the same period in 2022. On a year-to-date basis, combined adjusted EBITDA totaled $1.26 billion, as compared to $1.13 billion for the same period in 2022.

As of Sept. 30, 2023, Darling Ingredients had $119.0 million in cash and cash equivalents, and $1 billion available under its committed revolving credit agreement. Total debt outstanding as of Sept. 30, 2023, was $4.4 billion. The leverage ratio as measured by the company's bank covenant was 3.25X as of Sept. 30, 2023. Capital expenditures were $146.2 million for the third quarter 2023, and $380.6 million for the first nine months ended Sept. 30, 2023.

The company guidance for fiscal year 2023 is $1.6 to $1.7 billion combined adjusted EBITDA.

Segment Financial Tables (in thousands, unaudited)

| | Feed | Food | Fuel | Corporate | Total |

| Three Months Ended September 30, 2023 | | | | | |

| Net sales | $ 1,047,796 | $ 455,744 | $ 121,664 | $ - | $ 1,625,204 |

| Cost of sales and operating expenses | 804,312 | 338,208 | 96,213 | - | 1,238,733 |

| Gross Margin | $ 243,484 | $ 117,536 | $ 25,451 | $ - | $ 386,471 |

| | | | | | |

| Gross Margin % | 23.2 % | 25.8 % | 20.9 % | - | 23.8 % |

| | | | | | |

| Loss/(gain) on sale of assets | 833 | 117 | (21) | - | 929 |

| Selling, general and administrative expenses | 80,985 | 31,463 | 5,666 | 19,583 | 137,697 |

| Acquisition and integration costs | - | - | - | 3,430 | 3,430 |

| Change in fair value of contingent consideration | (5,559) | - | - | - | (5,559) |

| Depreciation and amortization | 88,954 | 25,418 | 9,026 | 2,596 | 125,994 |

| Equity in net income of Diamond Green Diesel | - | - | 54,389 | - | 54,389 |

| Segment Operating Income/(Loss) | 78,271 | 60,538 | 65,169 | (25,609) | 178,369 |

| | | | | | |

| Equity in Net Income of Unconsolidated Subs | 1,534 | - | - | - | 1,534 |

| Segment Income/(Loss) | $ 79,805 | $ 60,538 | $ 65,169 | $ (25,609) | $ 179,903 |

| | | | | | |

| Segment EBITDA | 161,666 | 85,956 Werbung Mehr Nachrichten zur Darling International Aktie kostenlos abonnieren

E-Mail-Adresse

Bitte überprüfe deine die E-Mail-Adresse.

Benachrichtigungen von ARIVA.DE (Mit der Bestellung akzeptierst du die Datenschutzhinweise) -1  Vielen Dank, dass du dich für unseren Newsletter angemeldet hast. Du erhältst in Kürze eine E-Mail mit einem Aktivierungslink. Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte. Andere Nutzer interessierten sich auch für folgende News |