Berg Believes Stratus Statement About CEO Armstrong Stock Sales Contrary To The Facts

PR Newswire

CUPERTINO, Calif., May 27, 2016

CUPERTINO, Calif., May 27, 2016 /PRNewswire/ -- Carl E. Berg, who is the largest shareholder (17.6%) of Stratus Properties Inc. (Nasdaq: STRS), today released the following:

On Page 16 of Stratus's May 2016 investor presentation, the company claims that its Chairman and Chief Executive Officer "has never sold Stratus stock in his over 20 years with the company."

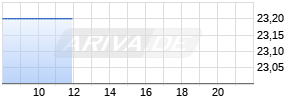

I would like to call to the attention of Stratus shareholders that on March 15, 2016, within a day after William H. Armstrong III, Chairman and Chief Executive Officer of Stratus Properties, trumpeted a jump in the company's estimated NAV per share of approximately 25% in the past 11 months to $44.34, he took the opportunity to transfer stock back to the company priced at $22.98 to pay taxes on recently vested stock grants. It is notable that Mr. Armstrong was willing to redeem his shares at 52% of the company's own published NAV estimate published a day earlier.

Though the shares of Stratus Properties have been relatively thinly traded according to NASDAQ for the last 15 years, the liquidity to sell or transfer shares back to the company to pay taxes or exercise stock options has been available to Mr. Armstrong, regardless of the prevailing trading volume in Stratus' shares.

According to Yahoo Finance, the trading volume in Stratus, which has been elevated since the filing of my Schedule 13D on December 21, 2015, was 31,800 shares on March 14, 2016. Mr. Armstrong's sale/redemption equated to roughly a third of the day's volume and he was able to achieve more per share than the previous night's closing price.

All but roughly 5% of the approximate 500,000 shares that Mr. Armstrong owns have come via stock grants or cashless exercise options over the years. Since 2005 Mr. Armstrong has sold or transferred to the company over 330,000 shares of stock receiving an average price of over $28 per share, a total of over $9 million.

Liquidity has never been an issue for Mr. Armstrong since his stock sales and transfers to the company are transacted on the Stratus balance sheet rather on the open market. For example, on December 27, 2006, when a total of 500 Stratus shares traded on the open market and closed at $31.49, Mr. Armstrong sold or transferred back to the company 121,123 shares at $31.20 per share to fund his exercise of options and to pay taxes. The average daily volume in the shares during the entire month in December 2006 was less than 2,000 shares.

Mr. Armstrong directly or through the company filings has warned of potential "creeping" takeovers and lectured on "control premiums" in addressing the reasons for the company's poison pill. It should be noted that he now owns 5.51% as April 15, 2016, of the company, almost all of which he acquired through cashless exercise of stock options and stock grants. He has also redeemed additional equity awards to pay taxes on a substantial portion of these grants and options.

https://www.sec.gov/cgi-bin/own-disp?CIK=0001200799&action=getowner

Stratus had 8.1 million shares outstanding as of December 31, 2015. According to Stratus public reports, approximately 1.69 million of those shares were issued to directors and officers via stock grants and stock options and a in private placement to a company controlled by a close personal friend of Mr. Armstrong at a deep discount to book value at the time. Contact:

Carl E. Berg

10050 Bandley Drive

Cupertino, California 95014

(408) 725-0700

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/berg-believes-stratus-statement-about-ceo-armstrong-stock-sales-contrary-to-the-facts-300276346.html

SOURCE Carl E. Berg

Mehr Nachrichten zur Stratus Properties Aktie kostenlos abonnieren

(Mit der Bestellung akzeptierst du die Datenschutzhinweise)

Hinweis: ARIVA.DE veröffentlicht in dieser Rubrik Analysen, Kolumnen und Nachrichten aus verschiedenen Quellen. Die ARIVA.DE AG ist nicht verantwortlich für Inhalte, die erkennbar von Dritten in den „News“-Bereich dieser Webseite eingestellt worden sind, und macht sich diese nicht zu Eigen. Diese Inhalte sind insbesondere durch eine entsprechende „von“-Kennzeichnung unterhalb der Artikelüberschrift und/oder durch den Link „Um den vollständigen Artikel zu lesen, klicken Sie bitte hier.“ erkennbar; verantwortlich für diese Inhalte ist allein der genannte Dritte.